Trust Foundation Integrity: Building Rely On Every Task

Trust Foundation Integrity: Building Rely On Every Task

Blog Article

Reinforce Your Heritage With Professional Depend On Structure Solutions

Expert count on foundation solutions offer a durable framework that can protect your properties and ensure your wishes are carried out precisely as planned. As we dive right into the subtleties of trust structure solutions, we reveal the vital aspects that can fortify your legacy and give a long-term effect for generations to come.

Benefits of Trust Foundation Solutions

Count on foundation options provide a durable structure for protecting assets and making certain long-lasting monetary safety and security for people and companies alike. One of the key benefits of trust fund foundation solutions is asset defense. By establishing a trust, people can shield their possessions from potential dangers such as suits, financial institutions, or unforeseen economic commitments. This security makes sure that the possessions held within the trust fund remain safe and secure and can be passed on to future generations according to the individual's desires.

Via counts on, individuals can describe exactly how their possessions ought to be managed and distributed upon their passing. Trusts also use personal privacy benefits, as assets held within a count on are not subject to probate, which is a public and frequently lengthy legal procedure.

Sorts Of Depends On for Heritage Preparation

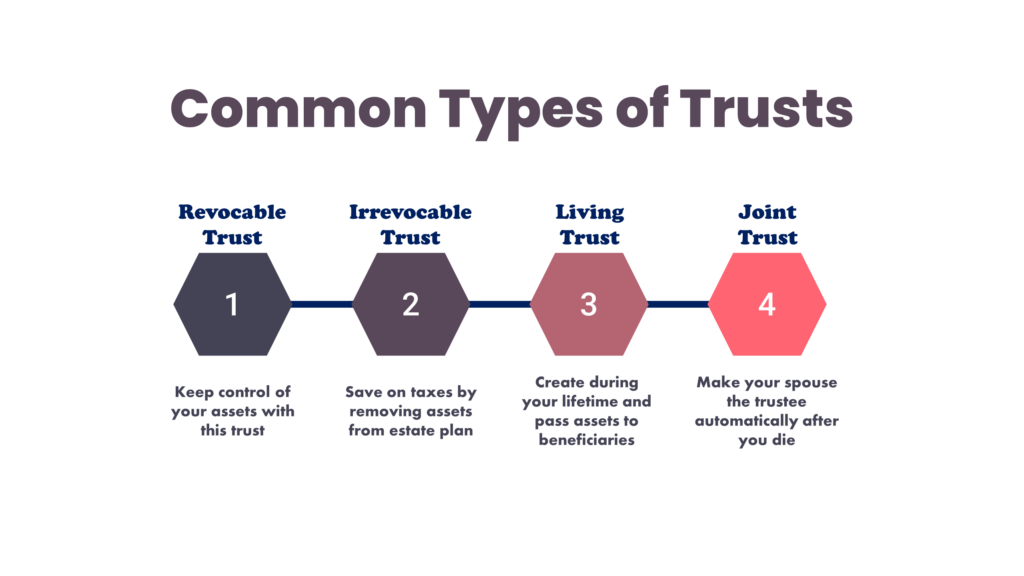

When taking into consideration heritage planning, an important element involves exploring numerous kinds of lawful tools developed to protect and disperse possessions efficiently. One common kind of count on used in heritage planning is a revocable living trust. This trust permits individuals to maintain control over their properties throughout their life time while guaranteeing a smooth transition of these properties to beneficiaries upon their passing away, preventing the probate process and giving privacy to the household.

Another kind is an irreversible trust, which can not be modified or revoked as soon as established. This trust fund provides prospective tax benefits and protects possessions from creditors. Philanthropic trusts are likewise popular for individuals wanting to sustain a cause while keeping a stream of income on their own or their beneficiaries. Special demands trusts are essential for people with disabilities to guarantee they obtain necessary care and assistance without jeopardizing government advantages.

Comprehending the various kinds of trust funds available for tradition planning is vital in creating an extensive approach that straightens with individual goals and priorities.

Selecting the Right Trustee

In the realm of tradition preparation, an important element that demands mindful consideration is the selection of a proper person to accomplish the pivotal role of trustee. Selecting the right trustee is a choice that can substantially influence the successful execution of a depend on and the fulfillment of the grantor's wishes. When selecting a trustee, it is important to prioritize high qualities such as credibility, economic acumen, honesty, and a dedication to acting in the most effective rate of interests of the beneficiaries.

Preferably, the chosen trustee should have a solid understanding of economic matters, be capable of making audio investment decisions, and have the capacity to navigate intricate lawful and tax obligation demands. Moreover, reliable communication abilities, interest to information, and a desire to act impartially are also vital characteristics for a trustee to have. It is recommended to pick somebody that is reputable, responsible, and have a peek at this website efficient in meeting the responsibilities and obligations related to the function of trustee. By meticulously thinking about these variables and selecting a trustee who straightens with the values and goals of the trust fund, you can assist ensure the long-lasting success and conservation of your legacy.

Tax Implications and Benefits

Taking into consideration the fiscal landscape surrounding count on structures and estate planning, it is vital to look into the detailed world of tax obligation effects and advantages - trust foundations. When developing a trust, comprehending the tax ramifications is vital for about his maximizing the advantages and lessening possible responsibilities. Depends on use numerous tax advantages depending upon their framework and purpose, such as minimizing inheritance tax, earnings taxes, and present tax obligations

One considerable advantage of certain count on frameworks is the ability to move properties to recipients with minimized tax consequences. Irreversible counts on can eliminate assets from the grantor's estate, potentially decreasing estate tax responsibility. Furthermore, some counts on enable for revenue to be dispersed to recipients, who may be in lower tax braces, leading to general tax obligation cost savings for the household.

Nevertheless, it is vital to keep in mind that tax regulations are complicated and subject to transform, stressing the need of seeking you can try this out advice from with tax experts and estate preparation experts to make certain conformity and take full advantage of the tax benefits of count on foundations. Properly navigating the tax effects of depends on can result in considerable cost savings and a much more efficient transfer of wide range to future generations.

Steps to Establishing a Count On

To establish a depend on efficiently, careful focus to information and adherence to lawful methods are vital. The primary step in establishing a trust is to clearly define the function of the trust and the possessions that will certainly be consisted of. This involves recognizing the beneficiaries who will certainly gain from the depend on and selecting a reliable trustee to take care of the assets. Next, it is important to pick the sort of trust fund that finest lines up with your objectives, whether it be a revocable trust fund, unalterable depend on, or living count on.

Conclusion

To conclude, developing a depend on foundation can provide countless benefits for legacy preparation, including asset defense, control over circulation, and tax benefits. By choosing the appropriate sort of depend on and trustee, people can secure their assets and guarantee their desires are accomplished according to their needs. Comprehending the tax ramifications and taking the required actions to establish a trust fund can assist reinforce your tradition for future generations.

Report this page